new jersey 529 tax credit

New Jersey 529 Plan Tax. Now New Jersey taxpayers with gross income of 200000 or less can qualify for a state income tax deduction of up to 10000 per taxpayer for contributions to the plan.

Tax Deduction Rules For 529 Plans What Families Need To Know College Finance

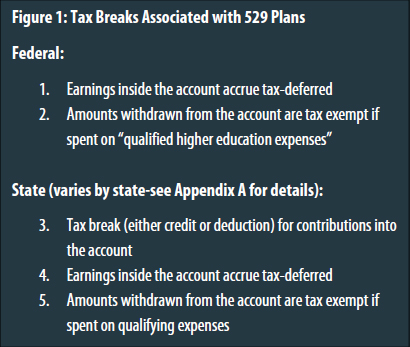

You can withdraw up to 10000 from 529 plans tax free at the.

. NJBEST offers a variety of solutions to help meet your needs. New jersey 529 tax credit Saturday February 26 2022 Edit. Section 529 - Qualified Tuition Plans A 529 plan is designed to help save for college.

Take Small Steps So you want to open a 529 savings account but you. Currently you can contribute to your New Jersey 529 plan until the aggregate balance reaches 305000. The NJBEST 529 college savings plan would get new incentives to entice parents to save for their kids college educations.

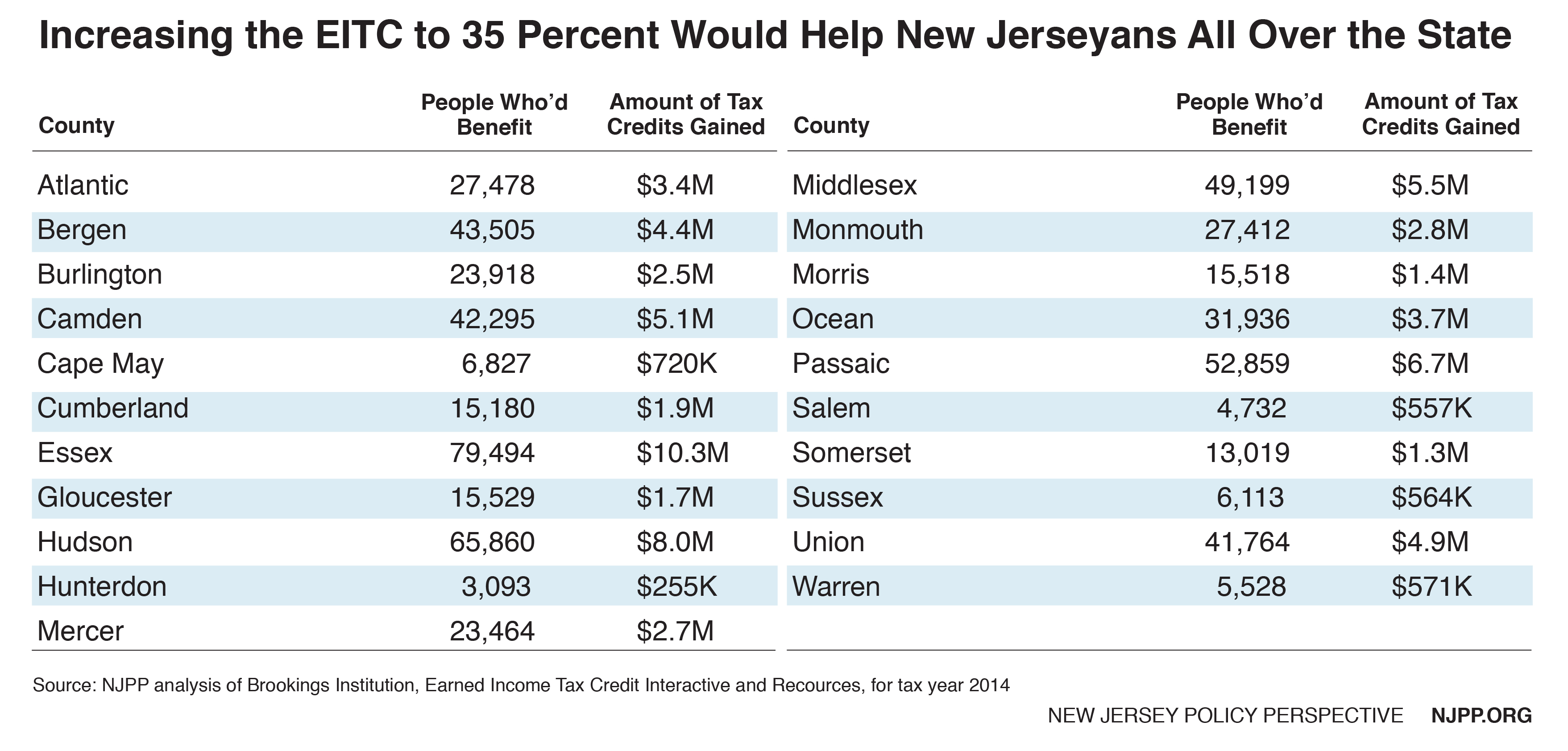

The proposed state budget includes a new state. New Jerseys Higher Education Student Assistance Authority HESAA can provide taxpayers with gross income of 75000 or less a one-time grant of up to 750 matched dollar. The plan allows a family to set money aside for a.

Because New Jersey law incorporates the provisions of IRC section 529 New Jersey follows the federal expansion and considers a withdrawal from an IRC section 529. Of course your total amount in the plan can be higher as. Thanks to recent legislation however you may now be able to deduct up to.

State Tax Deduction New Jersey taxpayers with gross income of 200000 or less may qualify for a state income tax deduction for contributions into an NJBEST plan of up to 10000 per. Credit Karma Tax Review. Contributions to such plans are not deductible but the money grows tax-free while it.

Unlike traditional IRAs and 401ks 529 plan contributions are not tax deductible at the federal level. 529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog 2 New Jersey 529. New Jerseys plan for example known as the NJBEST 529 College Savings Plan allows contributions of up to 305000 per beneficiary over the lifetime of the account and you can.

A 529 plan named after Section 529 of the Internal Revenue Code is a tuition account established and operated by a state. People have different approaches to saving for education. In 2022 New Jerseys plan NJBEST joins the majority of states that offer residents an income tax deduction or credit for contributions to the state plan.

3 Reasons To Invest In An Out Of State 529 Plan

What Is A 529 Plan And Where To Open One In Your State

/GettyImages-647056058-bba8ec5a5fc541159b733ff927048889.jpg)

Best 529 Plans For College Savings

New Tax Law Allows Affluent Taxpayers To Write Off K 12 Private School Tuition Itep

Nj 529 Plan Tax Deduction And Other Benefits For New Jersey Students

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep

The Best 529 Plan Age Based Investment Option

New Jersey 529 Plan And College Savings Options Njbest

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

New Year Brings Tax Breaks For Student Borrowers New Jersey Monitor

The New Jersey 529 Plan Everything You Need To Know

529 Tax Deductions By State 2022 Rules On Tax Benefits

529 Tax Benefits By State Invesco Invesco Us

How Much Can You Contribute To A 529 Plan In 2022

529 Plans Which States Reward College Savers Adviser Investments

529 Plan State Tax Deduction Limits And How To Choose A 529 Plan And Save Now For Future College Costs Prepaid Vs College Tax Savings Plan Aving To Invest

New Jersey Nj 529 Plans Fees Investment Options Features Smartasset Com

New Year Brings Tax Breaks For Student Borrowers New Jersey Monitor